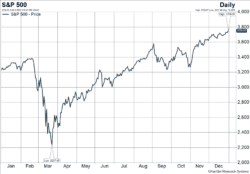

The S&P 500 wrapped up a surprising year with another strong week. The index of large-cap stocks, including dividends, climbed 1.5% and finished 18.4% higher for the year. Figure 1 shows the performance of the S&P 500, ex-dividends, in 2020 and just how far stocks have roared back from their lows. Global stocks powered 1.4% higher last week to finish the year up 16.3%. The Bloomberg BarCap US Aggregate Bond Index gained 0.2% and finished up 7.5% for the year.

Key Points for the Week

- The S&P 500 finished the year at a record high as value and small stocks outperformed in the fourth quarter.

- Long-term unemployment continues to increase even though the number of unemployed workers reached its lowest point since the pandemic began.

- 2020 offers powerful lessons.

Areas that had lagged during the first three quarters of the year benefited from news of a vaccine. Small-cap stocks, represented by the Russell 2000, rose an astonishing 31.4% in the fourth quarter, compared to the S&P 500’s increase of 12.1%.

Global and value stocks also posted strong fourth quarters. The MSCI ACWI rose 14.7% in the fourth quarter. The Russell 1000 Value gained 16.3%, besting the Russell 1000 Growth, which rose 11.4%. Even with the rally, growth stocks outperformed value stocks by more than 30% last year.

In economic news, 787,000 workers claimed initial unemployment benefits last week. While still high, that number has declined each of the past two weeks. There are still 19.6 million Americans receiving benefits.

Three pieces of data look likely to affect markets this week. The final major political event of the season is the runoff election for two U.S. Senate seats in Georgia, which will determine control of the legislative body. On Friday, the U.S. issues its December employment report that will provide additional information on how workers are being affected by the recent surge in COVID-19 cases. Finally, investors will be closely watching for vaccine delivery to accelerate.

Figure 1

A Look Back: Lessons from 2020

When 2019 ended, nearly every major issue affecting markets was moving toward resolution. The U.S. and China were reaching an agreement on trade, the impeachment of President Trump was nearly certain to result in acquittal, and a Brexit deal was reached. The known risks were quickly wrapping up in a world in which jobs were plentiful even if growth was slow.

Then COVID-19 spread across the globe. People became sick. Many died. The global economy was forced to a near shutdown to slow the spread of the virus. Jobs were lost and industries damaged. The longest bull market in history ended (Figure 1).

Faced with these immense challenges, expectations for a market recovery seemed fanciful, but markets have a way of confounding us. By the end of 2020, the S&P 500 had climbed more than 70% from its lows to finish at an all-time high.

What lessons should we draw from a year when most of the country struggled and the markets thrived?

- Policy matters: Actions by the Federal Reserve, the president and Congress all provided support to the economy and removed uncertainty. While some moves were likely unnecessary and others fell short of ideal, policymakers made a difference.

- Crisis accelerates innovation: One technology CEO said, “We’ve seen two years’ worth of digital transformation in two months.” Companies that were more innovative, especially in supporting work from home, prospered.

- Markets look forward and are made up of forward-looking industries: Markets anticipate changes to the economy by reflecting them in advance. In 2020, the market rallied long before the economy recovered. Public markets also have higher exposure to innovation. Technology and communications companies make up 36.6% of U.S. stock market capitalization, and that doesn’t include internet retail companies. One analysis estimates technology represented 12% of GDP in 2017. Even accounting for growth, the stock market is more exposed to innovation than the rest of the economy.

- Capitalism is resilient: Whether it was quickly reallocating resources to create COVID-19 vaccines or transitioning employees to working from home, capitalist systems adapted. Engaging the creativity and hard work of millions based on their expertise produces opportunities.

- Risk is always present: The strength of the market recovery should not be taken for granted. As vaccines are being administered throughout the world, investors should be reminded risk can come from expected or unexpected places.

2020 was a tough year for people that turned out well for many portfolios. The unequal rewards to innovative companies challenged some portfolios and managers. As we enter 2021, it is important your portfolio is in line with your risk tolerance and diversified. In the face of an uncertain future, diversification and rebalancing can be the extra dose of preparation your portfolio might need.

—

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

MSCI ACWI INDEX

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets (DM) and 23 emerging markets (EM) countries*. With 2,480 constituents, the index covers approximately 85% of the global investable equity opportunity set.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds

The Russell 1000® Growth Index measures the performance of the largecap growth segment of the US equity universe. It includes those Russell 1000® companies with higher price-to-book ratios and higher forecasted growth values.

The Russell 1000® Value Index measures the performance of the largecap value segment of the US equity universe. It includes those Russell 1000® companies with lower price-to-book ratios and lower expected growth values.

https://www.ishares.com/us/products/276537/

Compliance Case: 00913890